Import goods from America to Germany

I am not an EU citizen. I'm planning to go to the United States in February and I was going to buy computer parts there and bring them here, because the prices of parts are so expensive here. I read a lot of information on how much I’m allowed to bring and I'm pretty sure it's 430 Euros.

If I buy the parts in America on a website and it's around 420 Euros but it goes over 430 Euros with tax, does that count or does it have to be 430 Euros or less with tax included?

Also I'm going with my family and I was wondering if I can get 430 Euros worth of parts and my dad can get 430 Euros worth of parts separately with different names on the receipts. Will that work or is it 430 Euros all together as a family?

Also I am 15, so am I only allowed to bring 175 Euros worth of goods?

Best Answer

Its the value in the EU that counts. If it costs €440 including tax in the EU, then you cannot import it for free, no matter how much you paid.

On the other hand, it is per person, so your mum, your dad, your brother and your sister can each import under the limit. As long as it is for personal use. So they might have to state that their parts or for them, not for you.

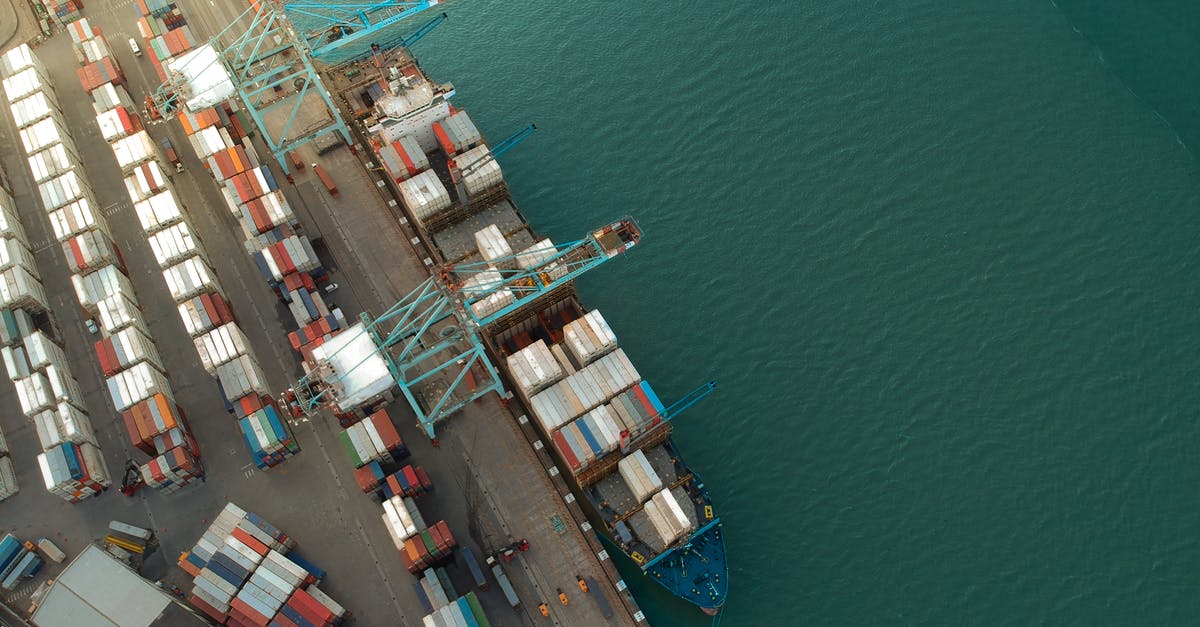

Pictures about "Import goods from America to Germany"

Do I have to pay import tax from USA to Germany?

Customs Duties and Taxes on Imports Germany is party to the European Union's Common Customs Tariff, therefore preferential rates apply to imports from countries which the EU has signed agreements with. Duties range from 0-17%, with the general tariff averaging 4.2%.What can I import to Germany?

Germany usually imports in these commodities:- Machinery.

- Data processing equipment.

- Agricultural products.

- Foodstuffs.

- Metals.

- Vehicles.

- Chemicals.

- Oil and gas.

How much can I import without paying duty in Germany?

The limit of 45 euros refers to the value of the goods including any Value Added Tax (VAT), as stated on the customs declaration. It is not required to include the costs of transport or postage in such declared value.Do I have to pay customs for package from USA to Germany?

Take the applicable customs regulations into account: imported goods from the USA and non-EU countries must be declared. The amount of customs duty is regulated by the customs regulation \xa7 29. Know all the important requirements with regard to paying taxes. Contact person for this is the General Customs Service.What You Need to Know Before Exporting to Germany

Sources: Stack Exchange - This article follows the attribution requirements of Stack Exchange and is licensed under CC BY-SA 3.0.

Images: Karolina Grabowska, Karolina Grabowska, Rafael de Campos, Ketut Subiyanto