Canadian import duties for a non-resident

I am a UK resident, and will be traveling to Toronto, Ontario in a couple weeks. I have ordered a laptop from a US company who state:

International orders ship via UPS. Generally, shipments are delivered within 4 business days of shipment. UPS will ship your computer to the nearest customs office. Once customs clears the package, you will be contacted for delivery authorization to your residence or place of business.

UPS service includes shipment and insurance. [We do] not collect taxes or duties for orders being shipped internationally. To determine taxes or duties owed, if any, please contact your customs office with both the description of your order and its total price.

The Canadian Government's calculator suggests I will owe a couple hundred dollars.

I will only be in Toronto for 2 days, and I'm shipping to a business address - but I cannot expect the business to pay the import duties on my behalf. How will the duties be collected, and will it be a time-consuming process?

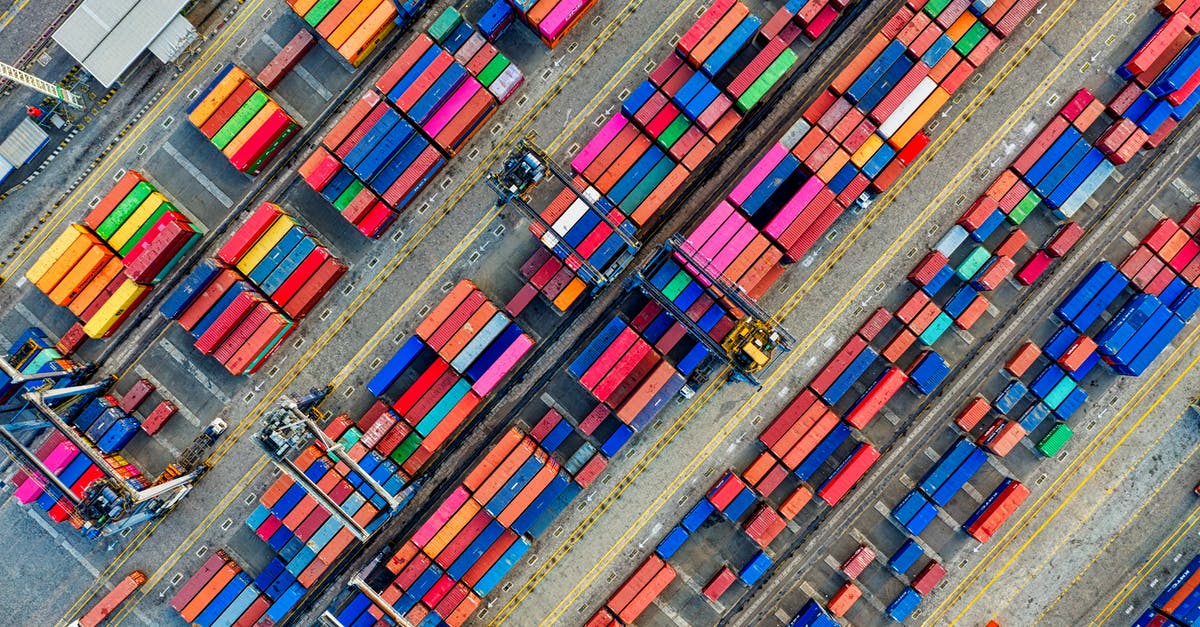

Pictures about "Canadian import duties for a non-resident"

Do non residents of Canada pay tax?

As a non-resident of Canada, you pay tax on income you receive from sources in Canada. The type of tax you pay and the requirement to file an income tax return depend on the type of income you receive. Generally, Canadian income received by a non-resident is subject to Part XIII tax or Part I tax.What is a non-resident Importer to Canada?

A Non-Resident Importer (NRI) is a business located outside of Canada that ships goods to customers in Canada and assumes responsibility for customs clearance and other import-related requirements.Does a non-resident wanting to import a product into Canada require a business number?

To become a Non-Resident Importer you must first obtain a Business Number (BN) from the Canada Revenue Agency (CRA) prior to importing into Canada. The Business Number is a unique 15-digit number companies in Canada use to transact with government agencies. You will also need an import/export account.What items are exempt from import duty in Canada?

You can claim goods worth up CAN$800 without paying any duty and taxes. You must have the goods with you when you enter Canada. Although you can include some tobacco products and alcohol, a partial exemption may apply to cigarettes, tobacco products and manufactured tobacco.Non-Resident Sale Of Property in Canada | Top 3 TIPS You Need to Know!

Sources: Stack Exchange - This article follows the attribution requirements of Stack Exchange and is licensed under CC BY-SA 3.0.

Images: Pixabay, Pixabay, Tom Fisk, Sascha Hormel