Canadian customs exception: shipping?

While Process for valuing items for customs purposes at the Canadian border discusses how an item is valued and one of the answers has

if you recently bought it, determining the value is simple: look on the receipt, perform a currency conversion, and you're done.

But if I bought it online, does shipping matter or not? I am looking at a 24 hours absence visiting a friend and the item is 140 USD (~190 CAD) but the shipping is 30 USD (~40 CAD) so shipping pushes it over the 200 CAD exemption.

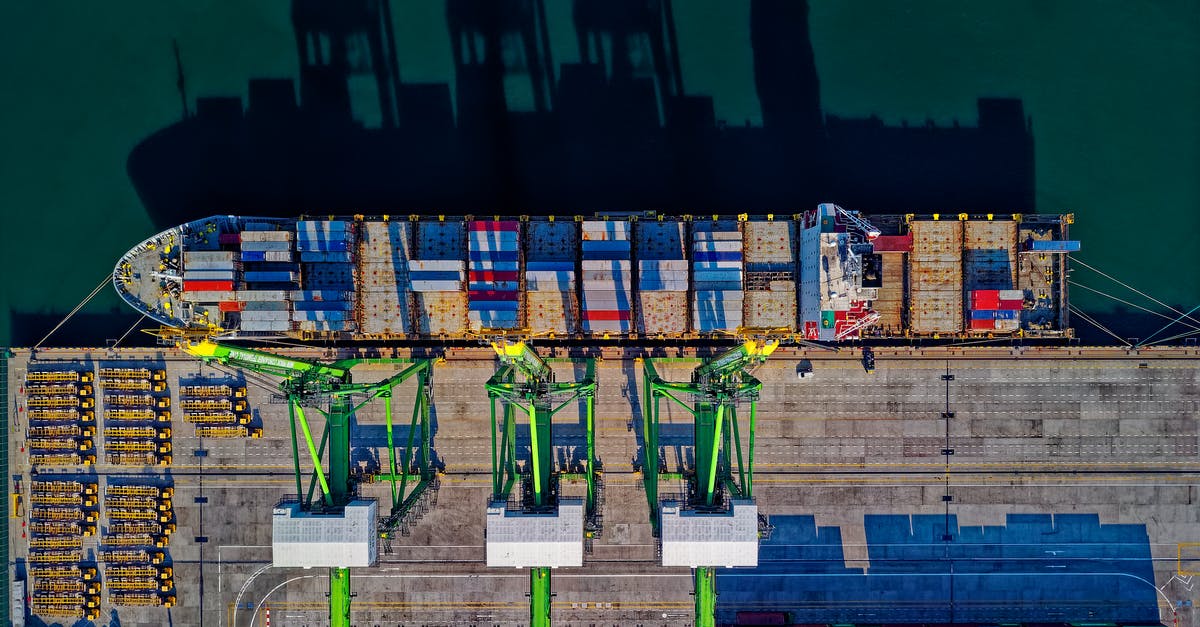

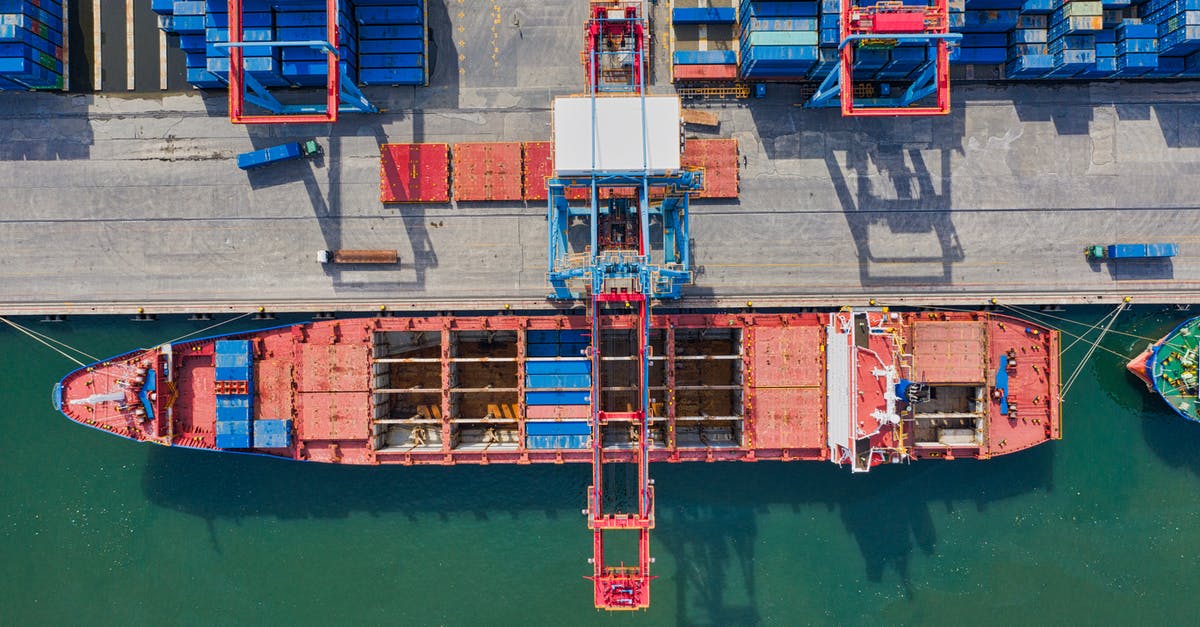

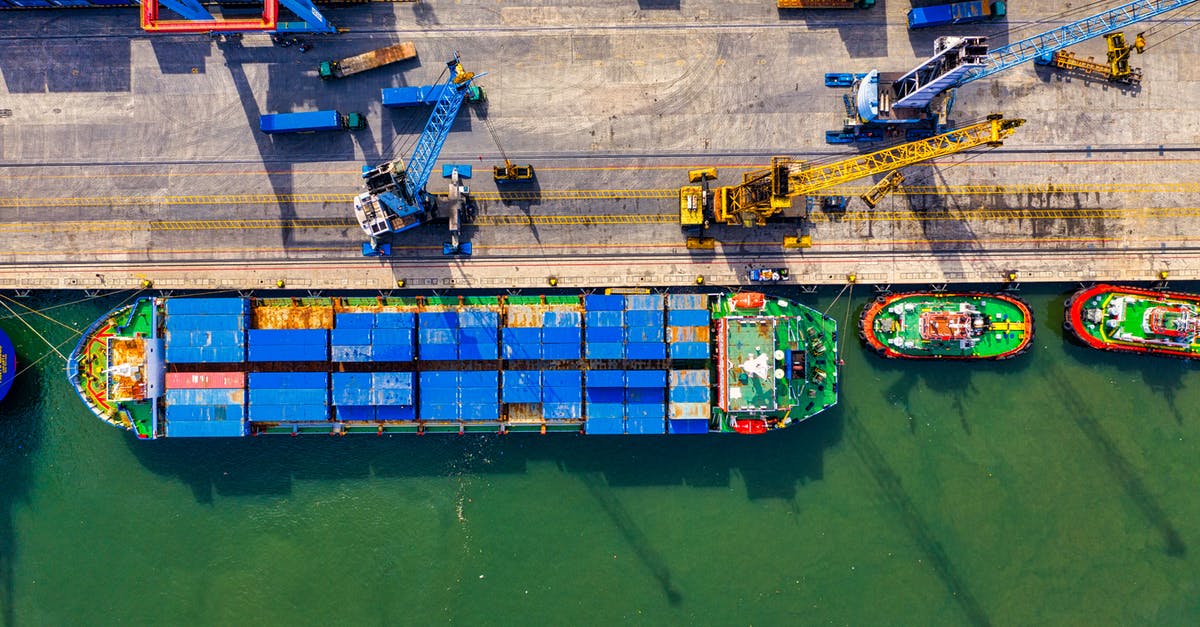

Pictures about "Canadian customs exception: shipping?"

What is the Canadian customs exemption?

You can claim goods worth up CAN$800 without paying any duty and taxes. You must have the goods with you when you enter Canada. Although you can include some tobacco products and alcohol, a partial exemption may apply to cigarettes, tobacco products and manufactured tobacco.How much can you send to Canada without paying duty?

Value in Canadian dollars Under the provisions of the Postal Imports Remission Order, if someone mails you an item worth CAN$20 or less, there is no duty or tax payable. If the item is worth more than CAN$20, you must pay the applicable duty, the GST or HST, and any PST on the item's full value.How do I avoid customs charges from USA to Canada?

Summary of How to Avoid Paying Custom FeesHow long will Canada customs hold my package?

The process can take anywhere from 12-48 hours and even longer during high traffic periods. If you're importing commercial goods with duties during the holiday period, you're going to see the longest wait time (outside of your business being audited, that is).Sources: Stack Exchange - This article follows the attribution requirements of Stack Exchange and is licensed under CC BY-SA 3.0.